All Categories

Featured

Table of Contents

It is necessary to note that your money is not directly spent in the supply market. You can take money from your IUL anytime, yet fees and give up charges may be connected with doing so. If you require to access the funds in your IUL plan, considering the pros and disadvantages of a withdrawal or a lending is essential.

Unlike direct financial investments in the securities market, your money value is not straight invested in the underlying index. dave ramsey iul life insurance. Instead, the insurance provider utilizes financial tools like options to connect your cash money worth development to the index's efficiency. One of the unique features of IUL is the cap and flooring prices

Upon the policyholder's fatality, the recipients obtain the death advantage, which is normally tax-free. The survivor benefit can be a set amount or can include the money worth, relying on the plan's structure. The cash money worth in an IUL policy grows on a tax-deferred basis. This indicates you don't pay tax obligations on the after-tax capital gains as long as the money stays in the policy.

Constantly assess the policy's information and talk to an insurance expert to totally recognize the benefits, constraints, and expenses. An Indexed Universal Life Insurance coverage policy (IUL) provides an one-of-a-kind blend of attributes that can make it an eye-catching option for particular people. Right here are several of the key advantages:: Among one of the most appealing facets of IUL is the capacity for higher returns contrasted to other kinds of long-term life insurance.

Taking out or taking a finance from your policy may minimize its cash money worth, survivor benefit, and have tax implications.: For those thinking about legacy preparation, IUL can be structured to supply a tax-efficient means to pass wealth to the following generation. The death advantage can cover inheritance tax, and the money worth can be an additional inheritance.

Iul

While Indexed Universal Life Insurance Policy (IUL) offers a range of advantages, it's important to consider the prospective downsides to make an educated choice. Right here are some of the key disadvantages: IUL policies are much more intricate than typical term life insurance policy policies or entire life insurance policy plans. Understanding just how the money value is linked to a stock exchange index and the effects of cap and floor prices can be testing for the ordinary customer.

The costs cover not just the expense of the insurance coverage however also administrative charges and the investment element, making it a pricier choice. While the cash value has the possibility for development based on a stock exchange index, that growth is frequently covered. If the index does exceptionally well in a given year, your gains will certainly be limited to the cap price specified in your plan.

: Adding optional attributes or bikers can raise the cost.: How the plan is structured, including how the cash money worth is designated, can additionally affect the cost.: Various insurance provider have different prices models, so searching is wise.: These are charges for handling the policy and are usually subtracted from the cash money value.

Iul Vs Roth Ira: Which Retirement Strategy Should You Choose?

: The costs can be comparable, but IUL uses a flooring to aid protect versus market slumps, which variable life insurance policies typically do not. It isn't simple to supply a precise price without a certain quote, as prices can differ significantly in between insurance policy companies and private scenarios. It's vital to balance the value of life insurance policy and the demand for included defense it supplies with possibly greater premiums.

They can help you comprehend the costs and whether an IUL plan straightens with your economic goals and requirements. Whether Indexed Universal Life Insurance (IUL) is "worth it" is subjective and depends upon your economic goals, risk resistance, and long-term preparation demands. Right here are some points to think about:: If you're looking for a long-term financial investment lorry that gives a survivor benefit, IUL can be an excellent option.

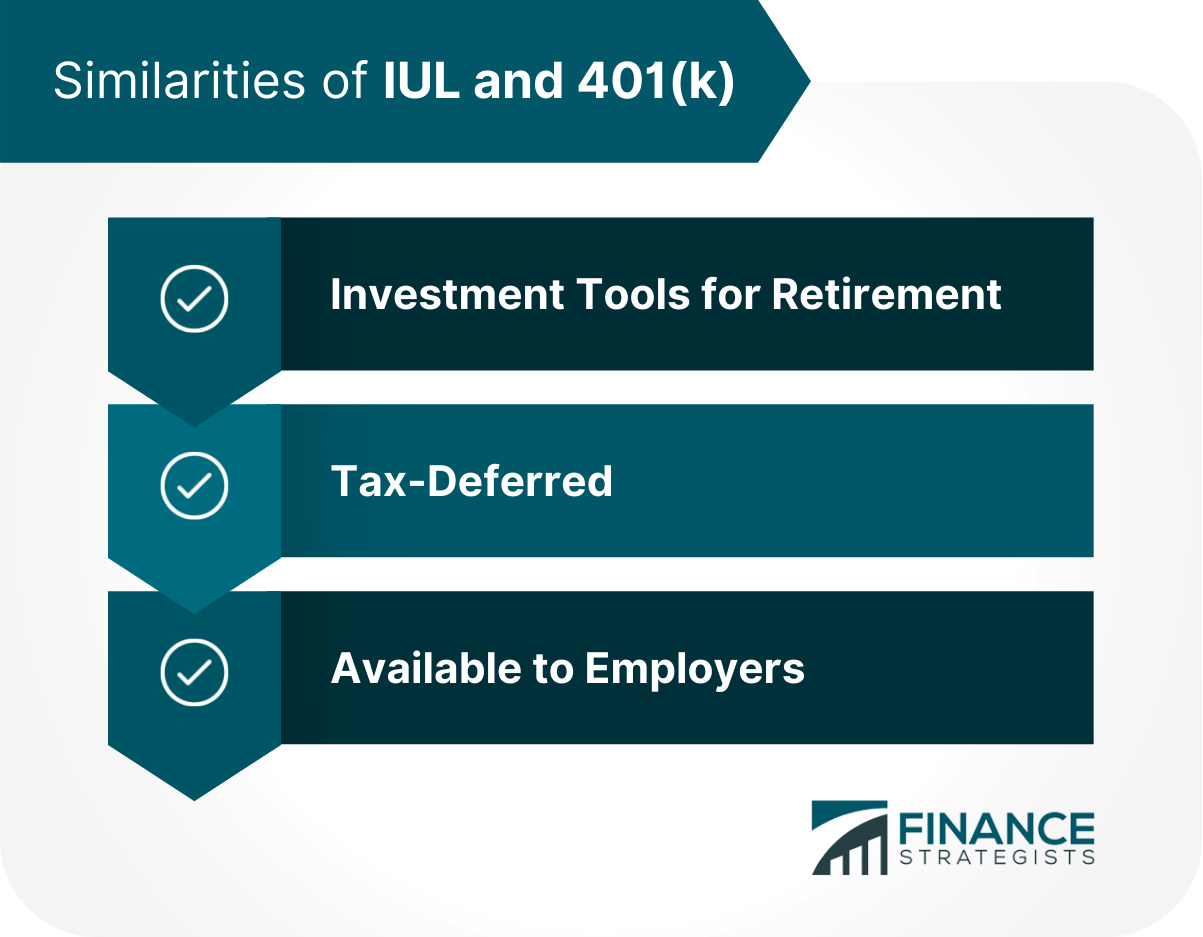

The very best time to begin getting ready for your lasting economic future is now. Two of the very best ways you can do that is by purchasing a retirement, like 401(k), and an Index Universal Life Insurance Coverage (IUL) plan. Recognizing the distinction between IUL vs. 401(k) will assist you plan efficiently for retirement and your family's financial health.

Financial Foundation Iul

In this situation, all withdrawals are tax-free because you've already paid tax obligations on that income. When you pass away, the funds in your 401(k) account will be moved to your recipient. If you do not mark a beneficiary, the cash in your account will end up being component of your to pay off any type of impressive financial obligation.

You might grow your Roth IRA account and leave all the cash to your recipients. Furthermore, Roth IRAs provide even more investment choices than Roth 401(k) plans. Regrettably, your only choices on a Roth 401(k) strategy are those provided by your plan supplier with.The disadvantage of a Roth IRA is that there's an income restriction on who can add to an account.

This isn't a feature of a Roth IRA. Since 401(k) plans and Index Universal Life Insurance policy feature in different ways, your savings for each and every rely on one-of-a-kind variables. When comparing IUL vs. 401(k), the primary step is to comprehend the general objective of retired life funds compared to insurance coverage benefits. Your retirement funds need to have the ability to maintain you (and your spouse or family) for a couple of years after you stop working.

You need to estimate your retired life requires based upon your current income and the standard of living you wish to maintain throughout your retired life. Typically, the expense of living increases every twenty years. You can use this rising cost of living calculator for even more accurate outcomes. If you find 80% of your existing annual revenue and multiply that by 2, you'll get a price quote of the amount you'll need to endure if you retire within the following 20 years.

If you withdraw roughly 4% of your retired life revenue annually (considering rising cost of living), the funds ought to last about 30 years. On the contrary, when contrasting IUL vs. 401(k), the value of your Index Universal Life Insurance plan depends on factors such as; Your existing earnings; The estimated cost of your funeral service expenditures; The dimension of your family; and The income streams in your family (whether a person else is utilized or not).

401(k) Vs Indexed Universal Life Insurance (Iul): Which Is The Better Investment?

In reality, you do not have much control over their allowance. The key objective of irreversible life insurance policy is to give added financial backing for your family members after you die. You can withdraw money from your cash worth account for personal requirements, your insurance coverage supplier will subtract that quantity from your fatality benefits.

A 401(k) supplies income defense after retired life. Each serves a various purpose. That's not to say you need to select in between IUL vs. 401(k). You can have both an Index Universal Life insurance policy policy and a 401(k) pension. You must recognize that the terms of these plans alter every year.

All set to get going? We're below for you! Reserve a totally free consultation with me now!.?.!! I'll address all your concerns about Index Universal Life Insurance Policy and exactly how you can accomplish riches before retirement.

Table of Contents

Latest Posts

Universal Life Insurance Company Ratings

Wfg Iul

Gul Policy

More

Latest Posts

Universal Life Insurance Company Ratings

Wfg Iul

Gul Policy